Conductive Finance

Slow Finance for Purpose Driven Enterprise

On the island, south of The Park, there are two iconic places about 5 miles away from each other that are instantly recognizable by movie lovers if not the entire English speaking world. The first is a piece of public infrastructure shrouded in romance where briefcase trading spies rub shoulders with runaway lovebirds. The second, a place of raw intelligence and vertical concentration of power where global shadow throwing games are played. These are not La Défense and Garre du Nord, nor Bankenviertel and Main Hauptbahnhof, but inexorably Grand Station Terminal and Wall Street, of Manhattan, New York.

What these pairings have in common is the contrast they generate; contrast perhaps best summarized by their regard of time. Time is an unforgiving monarch in train stations and is respected as such through omnipresent and out of reach ornate clocks. In finance, time is public information, the most perishable typeof there is, ornate at its best on individual wrists. This different rapport to time is indicative of different worlds. The reality of the train stations is generated by passengers permissionlessly committing along the train station protocol with the clear objective of A to B. On the counterpart, if Margin Call got it right, Wall Street is the premier MEV hub of the global economy where agents engage adversarially with no shared value proposition to optimize for. When not accepted as an intermediating truth, time becomes a competitive dimension. This cripples the possibility of coordination for added value games and plunges Wall Street in a narrow paradigm where the accrual of value is extractive and predominantly the product of frontrunning the bell by bell actualization of shared reality. The assumption that permeates this text, if any, is that the skyscraping trenches of Wall Street are dead weight in an economy that operates its books as public infrastructure. Conductive Finance aims to be a contribution in the direction of this more accessible and freer market that can capitalize on these inefficiencies.

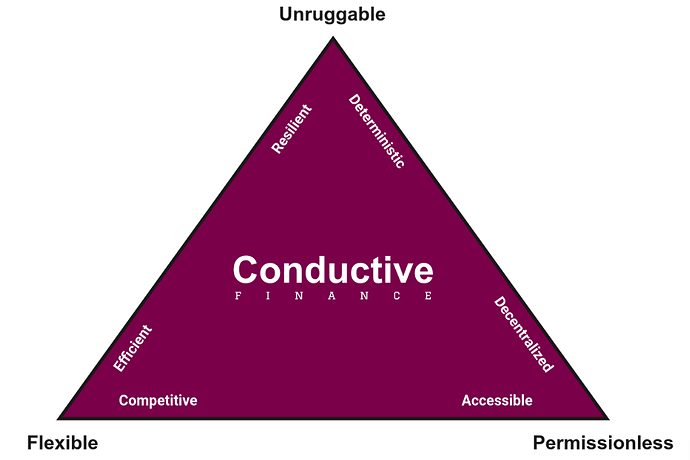

Conductive Finance aims to rebase value investment on the dynamics of purpose by leveraging accessible, trustworthy and consciously imparted ledgers in predictable, standardized and understandable ways.

Why trains?

For one, it is impossible to imagine the past 200 years without trains. Their economic impact cannot be understated nor their strategic use in all nation state affairs. The American experiment going west, the from mine to port lines of Africa, the signing of the 1918 armistice, Gandhi’s first act of civil disobedience, the historical, the mundane, the unfolding of the modern world is bound by trains.

The unique competitive edge of the train for travelers was not its comforts but the unspoken socialization of security costs. In this same way, the train as an investment vehicle reduces risks by declaring its purpose, aggregating stakeholders and advancing towards its specific, time limited or not end in predictable, deterministic ways.

Anna creates a train for A (now) to (a desired future state) B, and you traveler, fully aware of its operating parameters (be them immutable or governable), buy a ticket and join the ride. As with any train ride the ticket gets you in a space with other travelers. Being in means you can contribute to keeping the train in good working order or on the contrary, agitate a mutiny in case you feel the trains derailed from its original destination. As for value, the rules of any train apply. You get your full ticket’s worth by traveling to the station printed on the ticket. Oopsies do happen, and as with any “left the stove on” situation you can jump out. That can hurt, but it’s reassuring to know the doors are not locked between stations. Among other things, Zombies can also happen and you do not want to stay for very long on a zombie-ridden train, do you?

So, to summarize, no slick hair wiseguy lingo, just a train, a ticket and if desired, a community of stakeholders. No cloaks and daggers, only ticket based permissionless travel on an immutable or governable train.

If you are yet to be convinced, here’s some other things that spring to mind:

- Railways are the OG of Network Effects

- Stations are Community Events

- Trains are Memeable and Metaversable

- Implied Predictability

- Scale Agnostic

The disposition of trains as rolling financial vehicles is:

- flexible enough to contain permissionless bootstrapping of enterprising effort

- transparent and deterministic enough to make scams easily identifiable

- easy to understand, explain, depict, measure and compare

Lastly, and most importantly, the train ride is probably the most culturally universal protocol. However, if it so just happens that you’re a train hater, you can think of Conductive Finance as a publicly owned stock exchange (protocol), trains as listings and ticketed passengers as board member level stockholders.

Design Paradigm

Looking backwards, there are a few deliberate choices or emergent themes that ought to be mentioned.

Slow is better

Finance, being more consequential than food, is at its best cooked and served slowly. Just because we can eat fast food everyday, does not mean we should. Slow food is healthier.

Fast finance, the type that renders investment in cost externalization and server proximity profitable, is arguably a race to the bottom. The argument here is that financial instruments that are accompanied by reams of descriptive text and are leveraged at the speed of light are unlikely to be consistently conductive of good.

Under the assumptions that

- Finance serves peoples

- Speed increases risk

- Performance is relative

Conductive finance aims to be finance at human speed. The purpose of financial vehicles needs to be evident to and under the control of the humans it serves at all times. For something to be good, it has to be at least accommodating of a desirable future state of affairs. For something to stay good, its emergent state has to be predictable and to the largest extent at the whim of those agents that hold the targeted state of affairs desirable. Conductive finance wants to be consistently conductive of good, and as such limits maneuverability towards the desired destinations at speeds never greater than that of the humans it serves.

Conductive finance is your friendly and religiously good neighborhood finance, the kind that always waits for the granny to safely cross the street, all while sacrificing nothing of comparable importance.

Configurable permissionlessness

The core belief that shapes the protocol and that stands as the starting point for subsequent choices is that transparency, simplicity, built-in time delays and incentives can be instrumentalized in such a way as to create a trust minimized, anti-(rugpull)-fragile environment. The implementation makes a deliberate effort in upholding this thesis while providing sufficient flexibility to cover a variety of not yet imagined use cases. Good UX, analytics, standardized risk assessments and change tracking fueled by arbitrage opportunities or ticket burning will hopefully prove to be sufficient as to foster an accessible, healthy and value-focused investitional environment.

Immutable Transparency

Every action related to a train is indexed and transparent. Meaningful change can occur only through the protocol. Asymmetries can be quantified, risks can be measured, cross-project benchmarks, KPIs and ratings can be derived, curated and rendered commonly. New, fast paced and configurable proposals will necessarily be higher risk rated than less configurable slower paced ones. The intention is for train events to become valuable notifications on the passenger’s phone.

You can’t be [credibly] neutral on a moving train

The figurative ‘train ticket’ is an NFT that potentially grants access to vehicle steering and use of it as collateral. But the point here is not what you can do with an NFT, but what it means to be on a train. Any ticket as it is arguably the case with most forms of property is by its nature exclusive. You can prove ownership over something only insofar you can yield it in ways others cannot. Buying a stock is in many ways similar to becoming a member of a political party. Both are exercises of power that skew a distribution in a particular direction. The NFT ticket is not only a binary proof of one’s belonging to the stakeholder pool but a quantifiable public pledge of allegiance.

The Not So Obvious

Announcing in the EVM world what transactions will take place when, and according to what rules is likely to lead to potentially complex gaming. It is important for train listers to be aware of it and keep things simple. With novel logic come uncanny attack vectors. Transparency and predictability in train function execution should limit the impacts of value extraction on active value creation and accrual. However, protocols are like public spaces, you can anticipate flows and shape it to favor certain types of movement but you can hardly ever predict what weirdos will do. For example, it’s a stretch to think that when the christian God designed the seas it anticipated that dudes will part them and their own son will walk on one.

Small Picture Thinking

Towards a world where the average worker of Mumbai, Buenos Aires or Chișinău is infinitely more likely to go on lunch break and end up by the end of it as an inspired shareholder in the city’s newest New York style hotdog stand.

Evan’s Pizza

Anna, noticed a month after moving from New York to Evansville that there is no source of quality pizza in her neighborhood. It just so just happens that Anna always wanted to manage a pizzeria. So as one might expect, Anna decides to pursue this perceived communal need for quality pizza even though she has only 5% of the projected initial investment. She needs a seed round. So she researches the viability of such an operation and comes up with a budget and business plan. She also prints some flyers that briefly describe her audacious plan and points to Evan’s Pizza website that presents her business plan.

Now, Anna is not only business smart but also a web3 dev. She knows that using the traditional lawyer and paper intermediated route to raise the $95k she needs from the townspeople is impossible if not outright illegal. She is also aware that taking the easy venturing capital way out would mean that the business will be constrained by number go up logic, it will sypohn money out of Evansville and, caeteris paribus, generate significantly less sales than if she would manage to get lots of investors from within the community.

In order to set herself up for success, she deploys an ERC20 called Evans Pizza Coin (EPC) with a capped total supply of 101.000. She mints 6000 to herself as payment for the work and as the value corresponding to her initial investment of 5000 DAI. Now, she distributes her flyer in the mailboxes of all neighbors and goes on to present her project to local meetups. This gives all pizza lovers affected by the potential new venture an opportunity to buy-in at the ground level, from uniswap as a 10 DAI ‘retail investor’ or as an active, 1000 DAI governance participant, EPC train ticket holder.

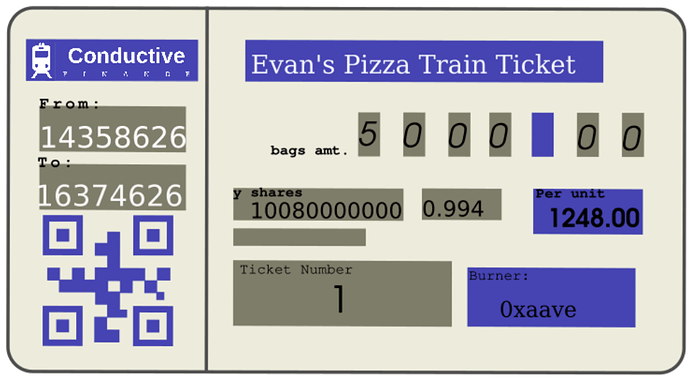

Evan’s Pizza Coin Train

Anna’s ticket

Anna stakes her 5000 EPC on block 114358626 for 2016000 blocks (targets to commit for 50 stations [weeks]) and receives the right to claim the 10080000000 shares (distance * bags amt.) of the generated pool yield beginning with the first station after the destination block. Anna is a founder and long term investor.

Joe’s ticket

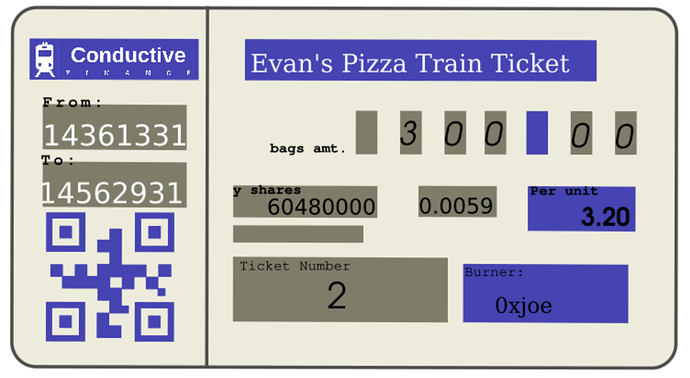

Joe buys 300 EPC tokens from Uniswap. He creates his ticket on block 14361331 for 5 stations. At the time, he’s the second investor. He knows the project is going to likely be a success and rise, at least temporarily in value. Being a rational actor, he buys 300 EPC and stakes it for 5 stations with a 3x buyout clause. Joe is a trader or short term investor.

Outcomes

There are many differences between Joe and Anna. Anna is committed to solving a communal problem and concentrates on conducting capital in its direction. Joe is more nihilistic, looks to accumulation of capital as an end In itself and as such advertises a 3x valuation for his EPC holdings. Both might not reach their stated yield shares maturity block as at any station they can be offboarded by getting their ticket flagged when the EPC / DAI TWAP (time weighted average price) is above their target price. Anna uses her ticket as collateral, and as such grants aave protocol burner privilege. Joe might see a shinier train somewhere else 1 station in and burn his ticket to pursue that instead. Both might reach their target station and offboard with the corresponding yield or the pizza shop might fail 5 weeks on food safety grounds and they might lose 90% of their investment.

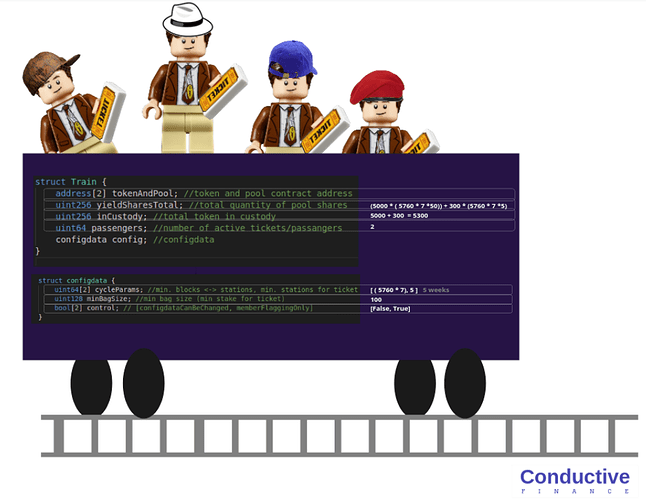

Trainworks

Describing the projected dynamics and considerations at play in this wannabe public good, permissionless and rugphobic investment sequencer is not a trivial task. So the aim below is to outline its main moving parts by listing some of its pulleys and levers in the hope that it will circumvent the need to categorize and articulate the many budding what-ifs that guided the non-procedural, iterative design approach this is a product of.

createTrain(

address _yourToken,

uint64[2] memory _cycleParams,

uint128 _minBagSize,

uint256[2] memory _initLiquidity,

bool[2] memory _levers

)

You cannot have a ticket without a train.

_yourToken: You cannot have a train without an ERC20.

_cycleParams[0]:You will set the minimum distance between trainStation(s).

_cycleParams[1]:You will set the minimum number of Stations for Ticket.

_minBagSize: You will set the minimum ERC20 deposit balance per Ticket.

_initLiquidity[]: Optional initial liquidity deposit

_levers[0]: Can this configuration be later changed by the trainOwner?

_levers[1]: Can anyone or only ticket owners flag tickets for arbitrage?

function createTicket(

uint64 _stations, // how many cycles

uint256 _perUnit, // target price

address _trainAddress, // train address

uint256 _bagSize // nr of tokens

)

One EOA can have one ticket for each existing train.

_stations: you want to travel with us for how many stations ma’am?

_perUnit: at what price per _yourToken you feel comfortable being offboarded?

_trainAddress: on what train? (train id and _yourToken/baseToken uniswap pool address)

_bagSize: how many of _yourToken will you deposit in the baggage wagon?

function burnTicket(uint256 _nftId)

public

nonReentrant

returns (bool success)

A ticket holder can burn their ticket and get back their deposited ERC20, or what remains of it if capital expenditures were part of the deal.

function flagTicket(uint256 _nftId, uint256 _atPrice)

Anyone, or as per Evan’s Pizza Coin Train configuration only fellow passengers can flag your ticket for arbitrage in the next station at a price. For the love of slow finance, the price needs to be above the ticket’s _perUnit, the price at the time of flagging needs to be above _atPrice and if this is to ever be execute, the _perUnit needs to be under the station to station TWAP when trainStation() is executed.

function requestOffBoarding(address _trainAddress)

offBoarding needs to and can be successsfully requested by an address if and only if their ticket’s destination block is smaller than the minimum block of the next trainStation(). A successful request results in the ticket being added to the offboarding array which is later iterated for a refund of _bagSize + corresponding yield in the upcoming trainStation().

List of all (current) 11 public state altering functions

Sighash | Function Signature

ad4e526a => updatesEnvironment(address,address,address)

2ce2b2a7 => changeTrainParams(address,uint64[2],uint64[2],bool[2])

ab16e18e => changeTrainOwner(address,address)

9e33e5e6 => createTrain(address,uint64[2],uint128,uint256[2],bool[2])

3d6672d1 => createTicket(uint64,uint256,address,uint256)

d323be3c => trainStation(address)

a476b73d => burnTicket(uint256)

bfe4fd2a => assignBurner(uint128,address)

f5328c23 => requestOffBoarding(address)

b5c55b3f => conductorWithdrawal(uint64,address,uint256)

86fb8c62 => flagTicket(uint256,uint256)

External Incentives

Why would anyone flag a ticket for arbitrage?

They receive the price difference of the flagging [(_atPrice - _perUnit)*bagSize] if still valid at trainStation() time. It’s a bit of a gamble so it might not be ideal for mempool frontrunning. Also, there’s an incentive for flagging as soon as it is profitable since only one such action per ticket, per intra-station period is possible. Last but not least, train owners can make it such that only ticket holders can flag a ticket.

In FUD we trust

Where the profit motif cannot be avoided in finance instrument design, there’s FUD. And like it or not, venturing capital and traidoors are roaming the web3 streets to get a nut. The attractive, ~0 cost for participation extractive opportunities that should keep these people entertained while the builders build “fully automated luxury gay space communism” are not enough to also keep the lunch break investors safe from themselves, at least not in the ways Elizabeth feels it warranted. To keep everyone happy, the protocol cashes on testing the faith of the ticket holder by spamming them with every small suspicious move or change in train health metrics. If the ticket holder gives in to FUD (for risk tolerance, opportunity costs reasons or by not being sufficiently aware of the decisions made on that train) and burns their ticket, the corresponding yield shares of that ticket are claimed and redeemed by the protocol treasury. The protocol gathers sel-sustaining resources through its immune system.This should prove sufficient to sustain future protocol iterations. If there’s no RUGs and FUDs, mission accomplished, there’s no need for a new version.

Collateral Beauty

If, let’s say Evan’s Pizza keeps its transactional records on chain, is “digitally transformed” (all its business metrics are dashboard in real time), sells pizza NFTs and makes and serves the corresponding pizza only when such an NFT is burned. What fundamental decentralization problem we might have just solved? We do have a pizza NFT, one that under a holistic pizza bond approach might resist inflation, obviously, but what should be even more obvious is that the pizza NFT can be sold. So, if you buy a crypto asset with fiat from a pizza shop that you can in turn sell or exchange for any other crypto asset, doesn’t that make the pizza shop a fiat onramp?

What makes it a public good

The jury is still out on this one and computing its adherence to a definition is pointless. What’s not beside the point of the attempt to categorize it as a public good is that it hopes to not only serve and empower wannabe pizza parlour owners and hotdog stand operators, but also to facilitate more resilient and inter-connected communities. Hopefully, one day, supporting local businesses will mean not only spending your money there but also actively investing it. This will lead to more responsible engagement for the betterment of public space but also to healthier, less carbon-intensive supply chains. And that’s good, and it’s good for the targeted public and can be seldomly expressed as good publicly, with no need to sell Moloch on it.

Current Needs, Wants and Maybe Not(s)

- No Multisig / Governance default

- Tokenomics analysis / simulations / attack vectors is a must

- Math is hard in solidity and bugs are likely

- Insufficient tests (brownie… you js junkies)

- Frontend, UX, Design (very important if this is to be ever used by a hotdog vendor)

- Deep optimize and refactor, or V2?

Questions

- Is it a toy? Is it a regenerative economy protocol? Is it an Incubator hub?

- Does it fit Devs for Revolution?

- To coin or not to coin? If coin, what and how coin? (POH, VC etc.)

- Where to deploy? (Optimism, zkSync, Arbitrum, starkNet, Polygon, Celo etc.)

- Should the protocol be immutable or modular? (react to block times, etc)

- With great upgradeable power come great ethical (blacklisting) responsibilities?

- Partners? (gitcoin, protein, gnosis, POH, transition networks, regens etc.)

P.S.

Developer DAO is in a unique position for creating, maintaining an internationalizing public goods. This project can contribute to building the capacity to flex this unique muscle in the upcoming station… I mean season.

Project Links

github

[project channel link (internal PLACEHOLDER)]

Follow Us on Twitter

Author: parseb

Probably Nothing Relating Links (in chronological order)

Local Currencies in the 21st Century

Harberger Tax

A Life Well Spent

Funding Public Goods for Fun and Profit