Coming here to share some evolved thinking based on the feedback from those who have shared their thoughts already here (thanks @luan @Crypdough.eth @Erik_Knobl @wolovim @Piablo @PSkinnerTech ) and from various conversations around the DAO between Contributors, Stewards, Members etc.

Summarising some sentiments, feelings/feedback and observations from around the DAO

- The DAO, and more specifically Labs, has not done enough to support and help elevate other Sub-DAOs in Season 2 (Especially Agency and Academy)

- Maybe not everything should be a Sub-DAO, rather Sub-DAOs should things that want to create a core D_D branded element of the Member experience/levels to the game we’re playing. This means the tight guide rails are are fairer ask. Members such as @Crypdough.eth (Raisan), P3RKS, Eden Protocol etc., can realise value from their Membership in other ways, such as Fellowship grants provided by Sub-DAOs, without having these restrictions on the business they’re creating.

- The current partnership model focuses on Partners rather than the community, is not very scaleable and does not provide natural, incentive-aligned collaboration opportunities and value share between the Sub-DAOs to life up the WHOLE DAO.

- It’s clear, at least to me, that these rails need to be defined to address the uncertainty around Sub-DAO and the impact that it has had on stalled proposals.

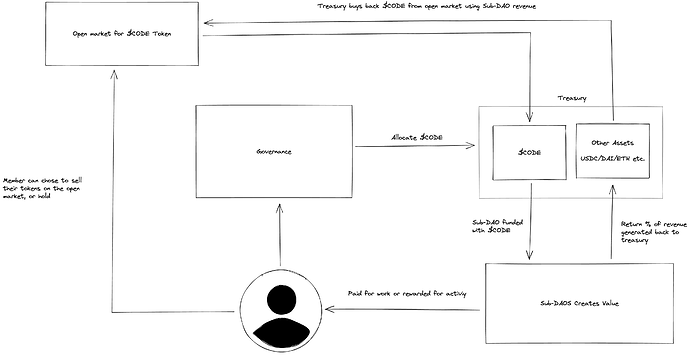

I want to propose an updated vision for Sub-DAOs, Labs role as the team handling most of the core DAO Functions (Community Management, Sales, Marketing & Ops), value-return to the DAO and value-share/support from Lab’s revenue to other Sub-DAOs.

Update Labs Model

The Labs team has been working hard to figure out a new model that funds the DAO, allowing us to shift back to a more community-focused > partner-focused experience. It goes roughly as follows:

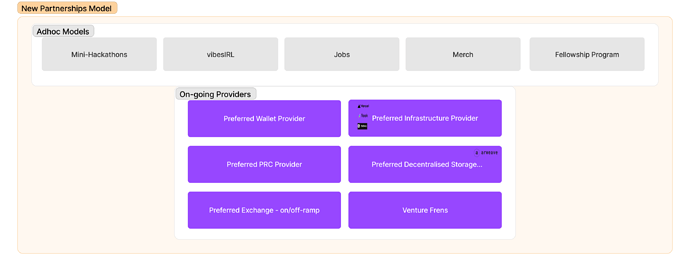

Preferred Partners

We’re pursuing a few “Preferred partners” for broadly applicable tooling our member use/need: RPC, Wallet, Exchange, Infrastructure, and Storage. They will pay a monthly fee to be used as the default provider we use across the DAO (i.e. in academy tracks, they would use this RPC and have a CTA for learners to sign-up for an account, maybe the Agency project get a nice elevated free account as well) and promote in our workshops and events and hackathons (i.e. CTAs in Youtube/Event descriptions).

This will provide baseline revenue to fund the DAO and free us up to create an experience around and driven by the Community rather than one that is constantly promoting partners.

We’re also starting to look to build a network of “venture frens” who will pay a monthly fee to get access to posting jobs for their portco’s on our job board and access to “deal-flow” from Developer DAO so projects coming out of the DAO or the fellowship/hackathons get introductions to venture partners when seeking investment.

Hackathons, Events, Merch, Jobs and Fellowships

On top of this ongoing revenue from preferred partners, Labs will drive more revenue from these areas to further grow the DAO treasury and be able to pay more Contributors to grow nd improve the community.

We have an update pitch deck for this model which I’ll share here in the coming days.

Supporting other Sub-DAOs

Revenue share on preferred partners

A % of the preferred revenue from partners is shared with Sub-DAOs to help fund the folks building out these new models in the DAO.

Sales, Marketing and Community support for Sub-DAOs

The Labs team will provide direct support Sub-DAOs to help elevate what they’re doing, drive community engagement/contributor flow for them and provide revenue streams the Sub-DAOs can allocate freely to their contributors/to fund their operations.

We’re seeing this play out as follows:

- Sub-DAOs have dedicated time/space within existing marketing/community events to promote what they’re doing, seek/funeel contributors etc. (i.e. space on Town Hall, in newsletter etc.)

- Labs partnership team will promote the services they’re offering to the partners we’re already speaking with (Already discussing lining up paid partners for Academy and can do the same to create more inbound deal flow for Agency)

A Sub-DAO Coordinator role

A paid role in each Sub-DAO for coordinating activity and contributor rewards, paid for out of the revenue the Labs team are generating under this new model.

Community-Driven Experience

This new model grants us the freedom to create a Community-driven experience whilst still growing the revenue that supports the DAO. We see this playing out in a few ways:

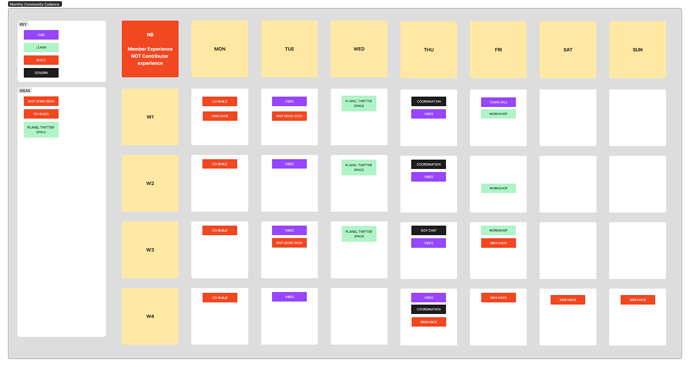

A regular cadence of community events each month

We’re scoping a regular set of community events we repeat each month anchored in providing value for Members. Currently, some of the more solid ideas are:

- Builder sessions: regular slots each week where 1/2 Contributors will be paid to be available to provide help/support to any Member that brings along a technical/product/whatever problem.

- Regular, Community-driven Twitter Space Panels: Spaces around topics (for example, zk) where we invite experts in the space to discuss topics the community has signalled an interest in).

- VIBES: Contributors paid specifically to host VIBES each week as part of the community team

We’re also considering a few other things, such as continuing the Wellness sessions with Emm and MVP/Feature demo sessions for Members to get feedback on what they’re building from other members. We’d LOVE to hear some ideas here for regular activities the community would like see happen.

At the end of each month we have a Hackathon and at the end of the quarter we run a fellowship program with partners like Press Start Cap x Developer DAO Fellowship.

Here is an image for what the average month might look like under this model:

CODE Rewards for every activity

CODE has been underutilised in the last quarter. For the next quarter, we’ll be proposing allocating CODE rewards, or rewards pools, to most of the important community activities.

For example:

- CODE for everyone who attends vibes and claims the VIBES NFT

- CODE for everyone who attends workshops and claims the BUILD NFT

- CODE for everyone who submits to hackathons

- CODE for everyone who submits for fellowships

- A CODE pool shared based on the amount of Praise issued to each person in Discord ( @Billyjitsu is working on implementing this system)

- CODE Membership giveaways on Twitter spaces

The goal here is to “spend” CODE to incentivise and reward the things that make the community grow and more valuable for everyone, similarly to how a DeFi protocol might issue yields to attract liquidity and make their protocol more valuable for users.

Importantly, this will also help us recruit more members and further decentralise voting power in the DAO into the hands of Members.

WIP Labs/DAO Budget

Here is a link to a WIP budget that supports this model well. This is not quite finalised but felt important to share this given to provide some context as to how the above can be achieved practically. We’ll keep updating this same document until we submit our full Sub-DAO budget proposal.

Potential Impact on this proposal

If Members supports this proposed vision and direction (please provide feedback), I believe it will help address many of the concerns raised in these comments related to how sub-dao’s are supported/we grow together and thus justification for value return to the DAO, to be reinvested in either future Sub-DAO’s, legal costs if we need to create new entities or CODE buybacks from the market.

It also likely means a reconsideration of the model for any Sub-DAOs that might eventually require new entities. I can imagine a world where those entities are majority owned by the foundation, and maybe some equity vests to the folks taking on the risk and responsibility of building it. We incubate these projects in the foundation, and then the DAO pays the initial (and supports on-going) legal costs to spin them out to empower contributors and isolate risk.

There is a lot to unpack here, and I am excited to hear people’s thoughts, feedback, critiques and suggestions. I’d also love to host a Twitter space where we can discuss this in an open forum that hopefully engages more folks who may not be paying attention to the forum or hanging out in Discord.

Hopefully, the above makes enough sense to spark some interesting conversation while we’re finalising the Labs proposal to support this approach.

cc @stewards